Tax

Understanding the Changes in Capital Gains Rules and Its Impact on Your Tax Bill

May 21, 2024

The 2024 Federal Budget created a stir among taxpayers, both individuals and the business community. While the details of the legislation have yet to be worked on, if enacted, the effective date would be June 25, 2024. It means you still have over a month to understand the tax changes and plan accordingly for yourself, your business, or your estate. This article will help you understand the proposed changes and how they could affect you.

Proposed Changes in Capital Gains Rules

Under the current rule, taxes apply to 50% of the capital gain. This gain can be from selling a property other than your principal residence, gain on investments, or transfer of company shares to the next generation. The rule is about to change. Instead of taxing 50% of the capital gain, 66.7% of the capital gain realized on or after June 25, 2024, will be taxable.

However, individuals and small business owners via sole proprietorships and partnerships small business owners have some respite. Individuals could continue to pay tax on 50% of the capital gain if the annual capital gain realized is up to $250,000. Any gain beyond that would be subject to the 66.7% inclusion rate.

So, if you sell a property for a gain of $500,000 after June 25, 2024, you will add $291,750 ($125,000 + $166,750) as capital gain to your 2024 taxable income instead of $250,000.

- A 50% inclusion in the first $250,000 ($125,000).

- A 66.7% inclusion in the second $250,000 ($166,750).

How Capital Gain Changes Could Affect Individuals’ Taxes

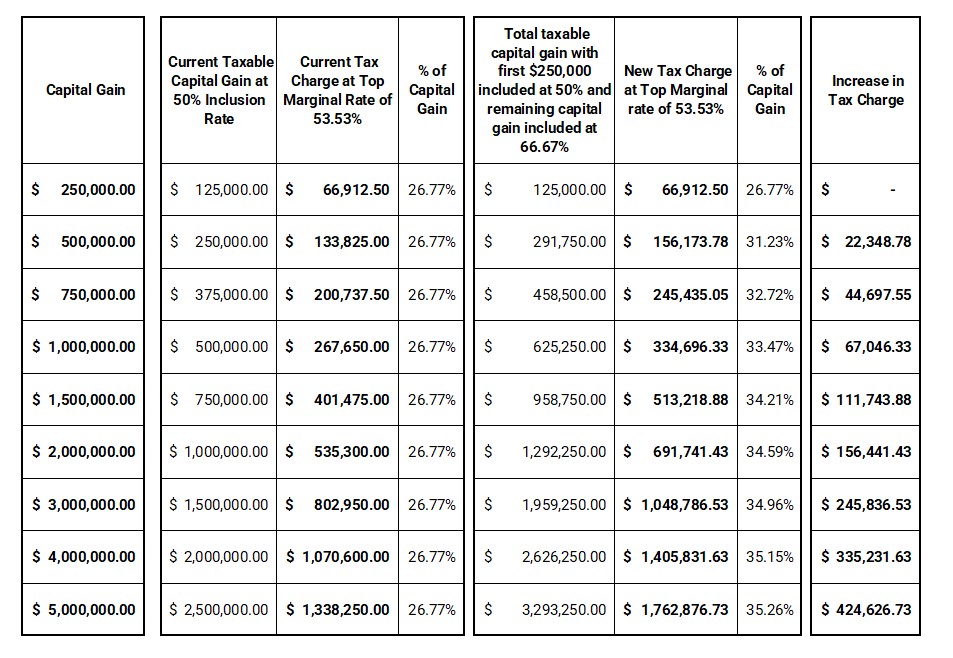

The proposed changes will bring higher capital gains under the tax purview. If we take the 2024 top marginal tax bracket of 53.53%, a 50% capital gain inclusion reduces your effective tax rate to 26.76%. A 66.7% inclusion rate above $250,000 will increase your effective tax rate progressively. Please refer to the table below or click on the following link:

Going back to our previous example, on a $500,000 capital gain, $291,750 will be subject to the 53.53% tax, which comes to $156,174 under the new rules. It is higher than the $133,825 tax liability under the current tax rules. The $22,349 additional tax bill might cause investors to consider realizing their capital gain before June 25. If you were to invest the $133,825 tax liability in an investment yeilding a 5% return, net of tax, it will take you about three years to earn that additional tax bill of $22,349. The higher the returns and the longer an investment is planned to be held, the more unfavourable realizing capital gains before June 25 becomes.

How Capital Gain Changes Could Affect Trusts and Corporations

There is no $250,000 threshold on capital gains for trusts or corporations. Any capital gain realized by the trust or corporation will be subject to the new inclusion rate of 66.7%.

However, trusts generally distribute all their capital gains among the beneficiaries and deduct the distributions from their taxable income, saving them from taxes. The tax liability falls on the beneficiaries as per individual tax rate.

Lifetime Capital Gains Exemption (LCGE) Limit Changes

The Canada Revenue Agency (CRA) allows business owners to benefit from the lifetime capital gains exemption (LCGE), under which you are exempt from capital gain up to a lifetime limit on the sale of shares of a Canadian Controlled Private Corporation. The LCGE limit will increase to $1.25 million as of June 25, 204. This means you will pay no tax up to a capital gain of $1.25 million. Gains above $1.25 million to $1.5 million will be subject to the 50% inclusion rule and beyond $1.5 million to the 66.7% inclusion rule. However, your business must qualify for the LCGE.

Others Who Will Be Affected by The Capital Gains Changes

Someone planning to sell a vacation home inherited from parents whose capital gain could be more than $250,000. They might face a higher tax bill unless they sell it before June 25. If you are selling your primary residence, the capital gain is exempt.

If someone who owns significant capital property (investments, real estate, art, gold) dies after June 25, 2024, the CRA rules require that any transfer of property be deemed a disposition at fair market value. The estate would then be liable for the taxes resulting from the taxable capital gains on the deemed disposition.

As the draft legislation is not yet ready, there is uncertainty around the changes on several fronts. However, if tax changes occur, they will be significant depending on the size of the estate. Taxpayers have a one-month window to understand, plan, and act on the possible changes.

What Changes Can I Make and Should I make them before June 25, 2024?

You can look to crystallize your capital gains prior to the effective date of the rule changes on June 25, 2024. This can be done by:

- Selling to a third party on an arms length basis

- Transfer to a related party individual or corporation as part of a restructure

- Transfer to a corporation while utilizing section 85 which can introduce some flexibility in deciding the amount of capital gain to realize

However, there are several factors to consider before deciding to trigger capital gains before June 25, 2024:

- Land transfer taxes on transfers of real estate

- Selling real estate too soon and being caught by the residential property flipping rules

- Whether the lifetime capital gains exemption limit increase to $1,250,000 effective June 25, 2024 will yield more of a benefit than the potential tax savings of triggering capital gains now

- Triggering of alternative minimum tax by realizing capital gains – this depends on the size of the capital gain being considered

- The present value of the tax payment in the future at the new inclusion rates versus the tax payment required today by triggering capital gains now. Depending on where your capital is deployed, the rate of return you would expect to receive, and how long you are intending to retain your investment, a cost-benefit analysis is necessary to determine whether the tax savings are worthwhile compared to the expected returns on your investment.

Contact Us

We can help you understand the implications of these tax changes for yourself, your estate, or your business. If you have significant unrealized capital gains, please contact us so we can assess your options. You can contact KSSP Partners LLP online or by telephone at 289-554-5997.