Tax

These 2024 Tax Changes Could Impact Your Budget and Tax Planning

April 4, 2024

It is time to file the 2023 tax before the April 30, 2024, deadline. During this time, we often realize how planning for taxes in advance can help ease the stress of April. It is not too late to start preparing for the 2024 tax year. The Canada Revenue Agency (CRA) annually changes reporting requirements, income thresholds, or tax rates. It sometimes introduces new tax laws mid-year that apply to income earned from January 1.

2024 Tax Changes

In 2024, the CRA did not introduce new tax credits but updated the thresholds and tax rates that could affect your daily budgets.

Changes in Payroll Deductions

Starting with the primary source of income, your salary, the CRA has increased the income threshold and contribution rates in 2024, which means lower disposable income but better benefits later.

- Canada Pension Plan (CPP): The CRA increased the maximum pensionable earnings for CPP from $66,600 to $68,500 in 2024, increasing your CPP contributions by $113. It has also introduced CPP enhancement Phase 2 in 2024, which means an additional 4% contribution will be deducted if your income is above $68,500 and up to $73,200.

- Employment Insurance (EI): The CRA has increased the insurance rate and maximum annual insurable earnings from 1.63% for $61,500 in 2023 to 1.66% for $63,200 in 2024 for employees. The maximum annual EI premium deduction has increased by 47 to $1,049.12 in 2024.

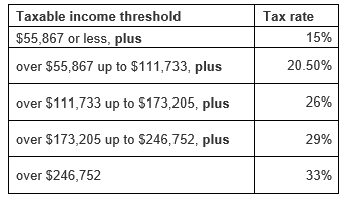

The CRA has adjusted all other deductions for inflation, such as the basic personal amount, age amount, and more. It has also increased the income thresholds for the federal tax rate to adjust for inflation.

Higher Taxes That Could Increase Your 2024 Expenses

The CRA has also increased taxes on certain goods and services, and you could feel the pinch as companies pass it on to customers through higher prices.

- Carbon Tax: From April 1, 2024, carbon taxes will increase from $65 to $80 per tonne, increasing the per litre fuel price to 17.6 cents from 14.3 cents. If you refuel a 70-litre minivan, it will cost you about $12.32.

- Alcohol Tax: On April 1, 2024, there will also be a 4.7% increase in the excise tax on beer, wine, and spirits because of the alcohol escalator tax.

- Digital Services Tax (DST): The CRA has also introduced a new 3% Digital Services Tax (DST) targeting large online companies with annual worldwide revenues of €750 million and annual Canadian digital services revenue of over $20 million. These companies will likely pass on some tax burden to consumers, making the services of Amazon, Uber and other online companies slightly expensive.

Changes in Reporting Requirements for Bare Trusts

The CRA also made some changes in the trust reporting requirements. For the 2023 tax year, even bare trusts, which were earlier exempt from filing returns, must file a T3 tax return and Schedule 15 disclosure, stating information on all parties that were a part of the trust during the 2023 financial year.

A bare trust is an arrangement where a person or company holds an asset or property in their name but is not the beneficial owner. They are just acting as an agent on behalf of the beneficial owner. For instance, a parent owns the title of a child’s home to help the child get a mortgage. The parent is not the beneficial owner but acts as an agent. This arrangement has no legal agreement, but it falls under the definition of bare trust and should be reported. You might want to seek professional help to get your taxes right.

Proposed Changes to Tax Laws That Could Come into Effect in 2024

Several tax laws are being discussed and could be implemented this year. However, they might be effective for any income earned from January 1, 2024 onwards.

- Intergenerational Business Transfers: A bill is proposed to add new conditions to intergenerational business transfers and employee ownership trusts. If you are a business owner considering transferring your business to your children or employees, your succession plans might have to consider the proposed changes.

- Alternative Minimum Tax: Another proposed amendment is to increase the alternative minimum tax (AMT) rate from 15% to 20.5% and broaden the scope of items included to compute the AMT. It is a minimum tax that high-income individuals have to pay if their adjusted tax is lower.

- Tax Deductions on Non-Compliant Short-Term Rentals: Homeowners can deduct certain expenses incurred to rent the property even for short-term rentals of less than 90 consecutive days. However, the proposed law might remove this expense deduction for properties that don’t comply with all registration, licensing and permit requirements.

These changes, if implemented, could bring significant tax liability.

Tax laws are complicated and keep changing. You might think you are compliant with all tax laws, but some one-off transactions or amendments in tax laws could make you eligible for some taxes or filings. However, a skilled tax consultant can help you prepare for these changes well in advance.

Contact KSSP Partners LLP in Markham to Help You with Tax Planning

A professional tax consultant is well-versed in the proposed tax laws and the nitty-gritty of the changing definitions. They can assess your finances and guide you on tax-efficiently proceeding with transactions. To learn how KSSP Partners LLP can provide you with tax planning services, contact us online or by telephone at 289-554-5997.